florida death inheritance tax

In Florida there are no estate or inheritance taxes. There is no inheritance tax in Florida but other states inheritance taxes may apply to you.

Florida Inheritance Tax Beginner S Guide Alper Law

This applies to the estates of any decedents who have passed away after December 31 2004.

. No State Estate or Inheritance Tax Florida residents do not need to worry about a state estate or inheritance tax which is a tax that is levied on people who either own property in the state where they died estate tax or inherit property from a resident of a state inheritance. An estate tax is a tax on a deceased persons assets after death. The federal estate tax only applies if the value of the estate exceeds 114 million 2019 and the tax thats incurred is paid out of the estatetrust rather than by the beneficiaries.

Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an. Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax. If someone dies in Florida Florida will not levy a tax on their estate.

Tax is tied to the federal state death tax credit to the extent that the available federal state death tax credit exceeds the state inheritance tax. 21 the estate tax rate was adjusted so that the first dollars are taxed at a 9 rate which ultimately maxes out at 16. To the extent its assets exceed the 1118 million exemption as of 2018 an estate is taxed at a marginal rate of up to 40.

A federal change eliminated Floridas estate tax after December 31 2004. However it is important to be aware that while there is no inheritance or estate tax the executor will still have to do the following. All Major Categories Covered.

Florida does not have a separate inheritance death tax. Florida doesnt have an inheritance or death tax. 22 the estate tax exemption was then increased in 200000 increments to reach 3.

Moreover Florida does not have a state estate tax. Florida doesnt collect inheritance tax. In Pennsylvania for instance the inheritance.

You may have heard the term death tax but estate tax is the legal term. If an individuals death occurred prior to that time then an estate tax return would need to be filed. Estate tax is a tax levied on the estate of a person who owned property upon his or her death.

As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance tax. The estate tax is calculated by multiplying the deceaseds possessions by a progressive rate of. Inheritance and estate taxesaka death taxeshave been legislated in a number of states across the country.

Fortunately there is an exemption called the Unified Credit which lessens the blow for most estates. Previously federal law allowed a credit for state death taxes on the federal estate tax return. The tax that is incurred is paid out by the trustestate and not the beneficiaries.

A very small number of states have inheritance taxes and again florida is not one of them. The Federal government imposes an estate tax which begins at a whopping 40this would wipe out much of the inheritance. The federal government then changed the credit to a deduction for state estate taxes.

In the State of Florida neither beneficiaries nor heirs named have to pay any income tax on any monies received from an estate. For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or inheritance tax. Although beneficiaries are responsible for paying the inheritance tax while estates pay the estate tax many estates step in to take this financial.

At the federal level there is only an estate tax. Florida Inheritance Tax and Gift Tax. There are no inheritance taxes or estate taxes under Florida law.

Then under legislation signed in march 2014 the state estate tax exemption was retroactively increased to 12 million for all 2014 deaths. An inheritance is not necessarily considered income to the recipient. There are no inheritance taxesor estate taxes under Florida law.

The death tax can be any tax thats imposed on the transfer of property after someones death whether that tax is based on the total value of the decedents estate or the value of a single bequest. If you have 5 million or less congratulations. This applies to the estates of any decedents who have passed away after December 31 2004.

Florida is one of those states that has neither an inheritance tax nor a state estate tax. File the decedents state and federal tax return by the tax date following the year they passed away. Thats right there is no estate tax for the vast majority of US citizens.

There is no inheritance tax in Florida because the property that is inherited does not count as income for the federal tax guidelines. The national government on the other hand levies an estate tax on all inhabitants of the United States. 9117 amended December 23 2003.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. However the federal government imposes estate taxes that apply to all residents. Federal estate taxes are only applicable if the total estates value exceeds 117 million as of 2021.

The federal government however imposes an estate tax that applies to residents of all states. Florida does not have a separate death or inheritance tax. This law came into effect on Jan 1 2005.

Florida doesnt have an additional inheritance death tax as previously stated. This tax is different from the inheritance tax which is levied on money after is has been passed on to the deceaseds heirs. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of.

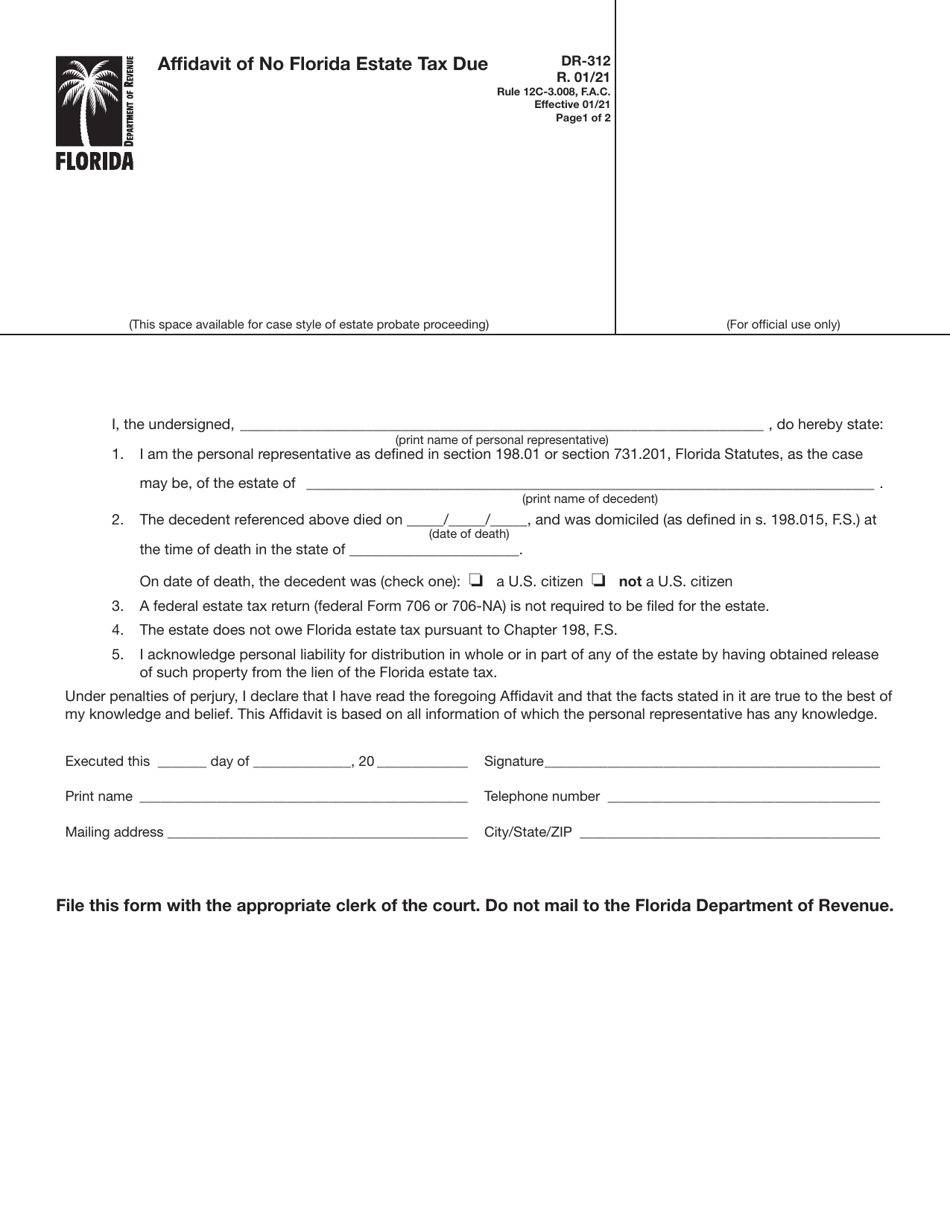

However the personal representative of an estate may still need to complete certain forms to remove the automatic florida estate tax lien. Nonetheless Florida residents may still have to pay inheritance tax when they inherit property from someone else. No florida does not have an inheritance tax also called an estate tax or death tax.

But that wont be an. An inheritance tax is a tax on assets that an individual has inherited from someone who has died. Pennsylvania had decoupled its pick-up tax in 2002 but has now recoupled retroactively.

If an individuals death occurred prior to that time then an estate tax return would need to be filed. Select Popular Legal Forms Packages of Any Category.

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Florida Estate Tax Rules On Estate Inheritance Taxes

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Inheritance Tax Beginner S Guide Alper Law

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

Eight Things You Need To Know About The Death Tax Before You Die

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Florida Probate Access Your Florida Inheritance Immediately

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Florida Attorney For Federal Estate Taxes Karp Law Firm

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

Taxes In Florida Does The State Impose An Inheritance Tax

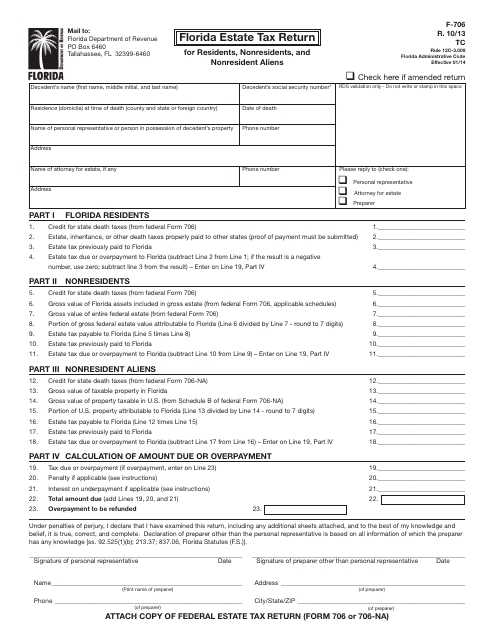

Form F 706 Download Printable Pdf Or Fill Online Florida Estate Tax Return For Residents Nonresidents And Nonresident Aliens Florida Templateroller